Remuneration

Neste's approach to remuneration

Our Remuneration Policy provides a structure that aligns remuneration with the successful delivery of our long-term strategic and sustainability goals as the world’s leading producer of sustainable aviation fuel and renewable diesel, and is based on our four guiding remuneration principles:

Ensure the execution of Neste’s strategy: Neste aims to chart a clear path forward by executing its strategy and sharing its business objectives.

Drive performance and value based behavior: Neste aims to drive results by rewarding excellence, development and value based behavior.

Encourage individual and team accountability: Neste promotes clear targets and a focus on continuous performance improvement. Neste enables this by maintaining an ongoing dialogue with employees and by encouraging employee feedback.

Be fair and transparent: Neste runs performance and total rewards processes ethically and with integrity, and supports this with clear communication.

Neste’s remuneration concepts such as variable pay programs and performance measures for these programs are developed with these principles in mind. These same principles that are applied to the President and CEO are also applied to other employees, and the Personnel and Remuneration Committee reviews and considers employee pay, conditions and engagement across the broader employee population and reward-related feedback collated on the total employee experience.

Remuneration governance

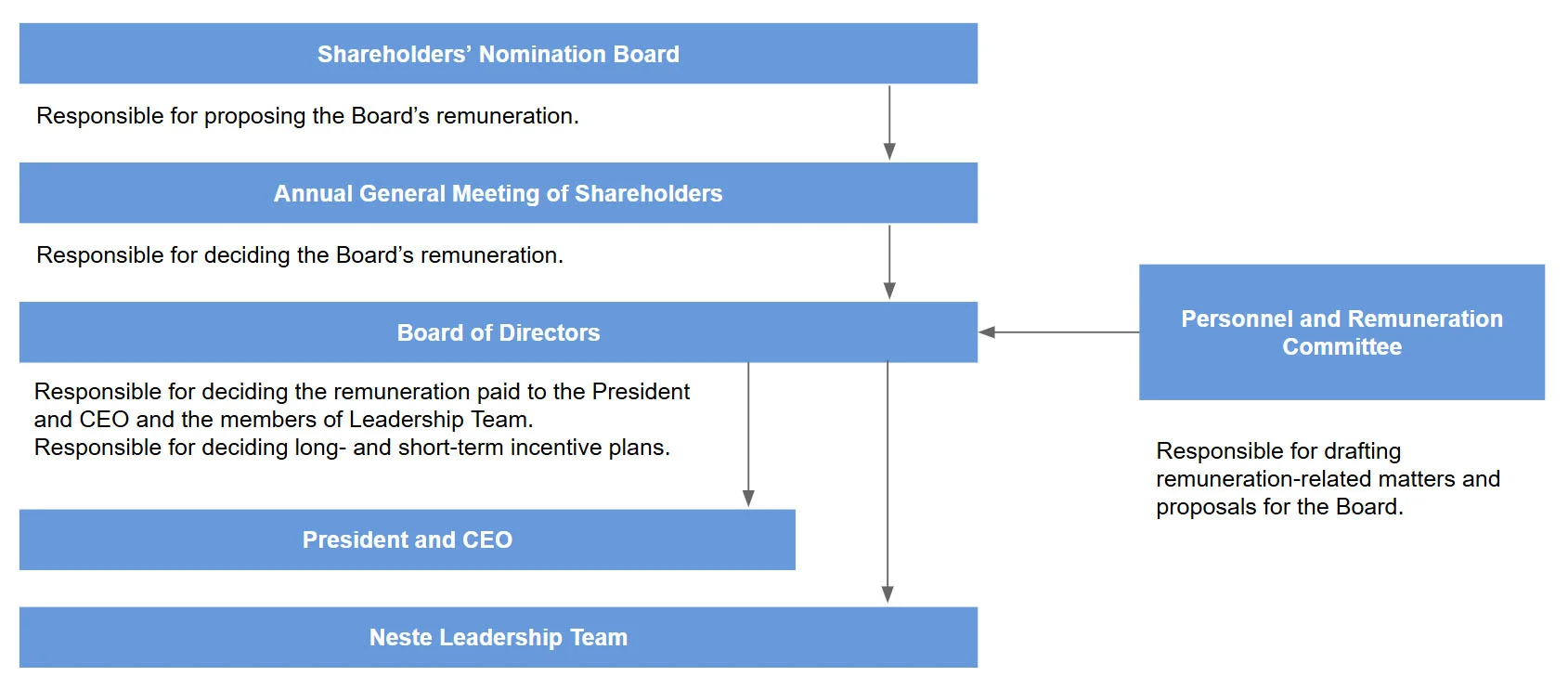

Remuneration-related discussion and decision-making at Neste involves the Shareholders’ Nomination Board, the Annual General Meeting of Shareholders, the Board of Directors, and the Board’s Personnel and Remuneration Committee. The Shareholders’ Nomination Board submits a proposal concerning the remuneration payable to the Board of Directors to the AGM. Upon the recommendation of the Personnel and Remuneration Committee, the Board of Directors submits the Remuneration Policy (at least within every 4 years) and Remuneration Report annually to the AGM and decides on the remuneration and remuneration elements of the President and CEO within the confines of the Remuneration Policy.

The decision-making process, which is outlined in the chart, guarantees that decisions are fair and unbiased. Remuneration is set according to the "grandparent principle" whereby the pay of any individual is subject to the approval of a manager's manager. No individual may decide or participate in decision-making in matters relating to their own remuneration.

Decision making process in remuneration

Downloads

File Name | Type | Size | |

|---|---|---|---|

| Neste Remuneration Report 2024 | 590 kB | Download | |

| Neste Remuneration Report 2023 | 215 kB | Download | |

| Neste Remuneration Report 2022 | 312 kB | Download | |

| Neste Remuneration Report 2021 | 530 kB | Download | |

| Neste Remuneration Report 2020 | 482 kB | Download | |

| Neste Remuneration Statement 2019 | 336 kB | Download | |

| Neste Remuneration Statement 2018 | 235 kB | Download | |

| Neste Remuneration Statement 2017 | 265 kB | Download | |

| Neste Remuneration Statement 2016 | 225 kB | Download | |

| Neste Remuneration Statement 2015 | 232 kB | Download |

Share this